FamZoo Review: The Ultimate Family Finance Tool You Must Try

As a parent, the challenge of imparting personal finance skills to our kids can be daunting. But what if there was a magical tool that could make the learning process enjoyable and effortless for all? That’s where FamZoo enters the scene. In FamZoo review, we’ll explore deeper into the application’s features and the reasons why it is a worthy investment for your family’s financial future.

This article has been written and updated by S. M. Rosyida, last updated 1yr ago. If you like to read FamZoo Review, we must tell you that other 4 readers also love to read more Financial App Reviews.

total so far read 4x, And readers in August will likely continue to increase.

FamZoo Review

FamZoo is a finance application that enables parents to teach their young ones the art of budgeting, saving, and wise spending.

In FamZoo, parents can easily create a virtual family bank to educate and empower their children. With the click of a button, little ones can learn the value of money, the art of budgeting, and the joy of saving.

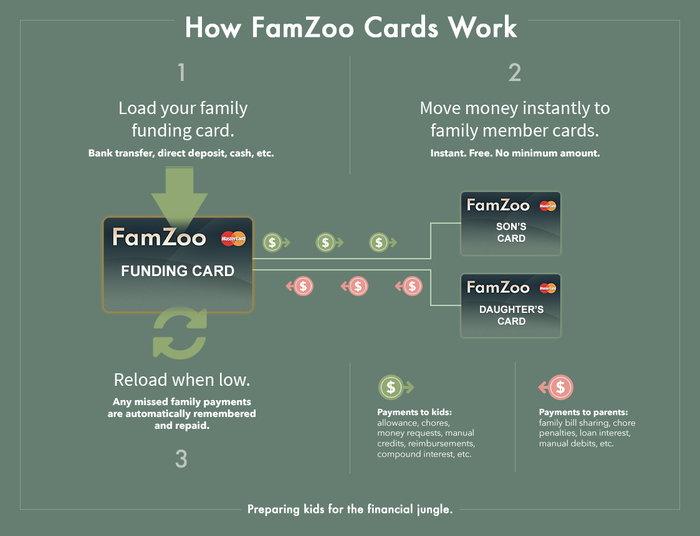

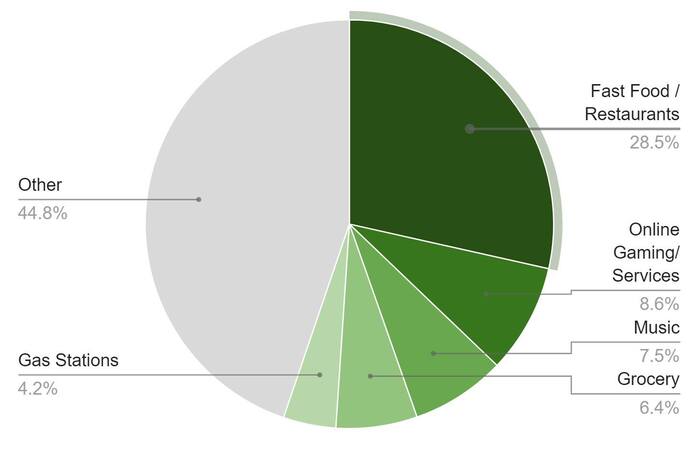

One of the most remarkable features is the prepaid card system. With this tool, parents can easily load funds onto their child’s card, while their children can spend their money wisely both online and in-store. This helps teach children to be responsible with their funds and to plan their purchases thoughtfully.

Furthermore, parents can also set up savings goals for their children on FamZoo. This fantastic feature allows little ones to allocate a portion of their allowance or other earnings into their savings account, teaching them the value of saving for the future.

Children can explore the many facets of finance with the guidance of their parents. This platform is the perfect solution for families who want to create a fun and interactive way to teach their children the essential life skill of financial management.

To give you more insights about this platform, this FamZoo review will guide you to an in-depth discussion about what it can be beneficial for you.

Why FamZoo?

Most of you might be curious about what this platform can do and why it should be your savior in teaching your kids about budgeting. Thus, below are the following points you must know about this platform.

FamZoo Highlights

- User-Friendly Interface

FamZoo is incredibly easy to use and navigate, even for those who are not tech-savvy. Its user-friendly interface ensures that users can quickly get started and manage their accounts hassle-free. - Flexible Account Set-Up

Parents can customize their children’s accounts based on their unique needs. FamZoo allows parents to pay allowances on a weekly or monthly basis, assign recurring or one-time chores, and even set up savings goals. This flexibility ensures that parents can adapt the app to their family’s needs. - Affordability

This platform is highly affordable, making it accessible to families on a budget. Users can sign up for a one-month free trial to test the app before paying just $5.99 per month for up to four prepaid cards. This price point is significantly cheaper than other family finance apps on the market, making it an excellent value for money.

What's On FamZoo

FamZoo offers features designed to help parents teach their children about money. And this list will show you.

- Prepaid cards

Parents can order prepaid cards for their children, which are linked to their FamZoo account. The kids only spend the money that has been loaded onto the card. - Allowances

Parents can set up allowances on a weekly or monthly basis, and assign them to specific chores or as a general allowance. Kids use their prepaid card to access their allowance. - Chores

Parents are able to assign chores to their children and track their completion. This is a great way to teach kids about responsibility and the value of hard work. - Savings goals

You set up savings goals for their children, and kids can work towards them by allocating a portion of their allowance or other funds into their savings account.

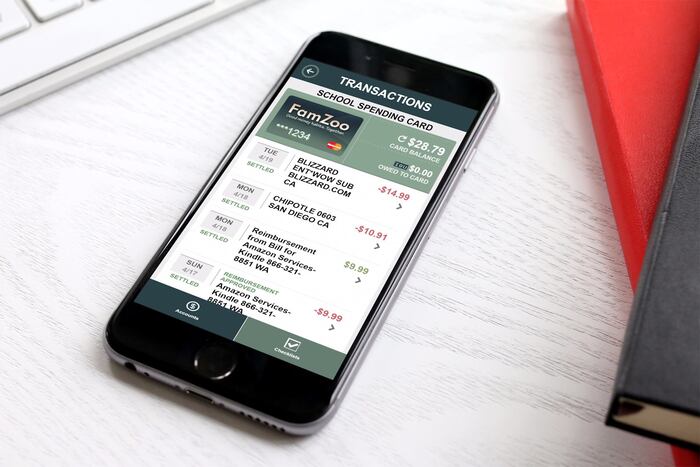

FamZoo Prepaid Card Review

With this card, parents will load funds onto it and their children then use it to make purchases, both online and in-store, wherever MasterCard is accepted. But that’s not all – the FamZoo prepaid card is an example of a true friend, always dependable and never imposing any sneaky hidden costs or overdraft fees.

With this prepaid card, parents can set spending limits, enabling their children to only spend what’s been loaded onto the card. In the end, the FamZoo prepaid card is not just a financial tool but also an investment in a bright and successful future for our children.

How To Order FamZoo Card

Ordering a FamZoo card is a simple and straightforward process. To get started, you’ll need to sign up for an account and select the “prepaid cards” option.

From there, you can order as many cards as you need, and they’ll be shipped to your home within a few days. You can then activate the cards online and load funds onto them.

FamZoo vs. Greenlight vs. Gohenry

FamZoo isn’t the only family finance app on the market. Two other popular options are Greenlight and Gohenry. So how do they compare to FamZoo?

Greenlight is a finance app offering many features, such as FamZoo, including prepaid cards, chores, and allowances. People already know it due to its early release. Gohenry is another app that has prepaid cards and allows parents to set up savings goals for their children.

However, Gohenry is significantly more expensive than FamZoo, with monthly fees ranging from $3.99 to $9.99 per child.

FamZoo Pricing

There are some pricing options that you can choose once you register on FamZoo.com. Here we summarized the options.

- Monthly: $5.99

- Pay-in-Advance

PAY EQUALS SAVE $25.99/6 Months $4.33/Month $9.95 or 27% $39.99/12 Months $3.33/Month $31.89 or 44% $59.99/25 Months $2.50/Month $83.77 or 58%

FamZoo Pros & Cons

Understanding the brand’s advantages and disadvantages is a must before buying the products you wanna buy. Thus, here is the pros & cons list you should know about FamZoo.

FamZoo Pros

- Affordable pricing

FamZoo is one of the most affordable family finance apps on the market, making it accessible for families on a budget. - User-friendly

FamZoo is incredibly easy to use, even for those who aren’t tech-savvy. - Flexible

FamZoo provides a lot of flexibility in terms of how parents can set up their children’s accounts, so you can customize the app to meet your family’s unique needs.

FamZoo Cons

- No physical bank locations

FamZoo is an online-only tool, so you won’t be able to visit a physical bank location if you have questions or concerns.

FamZoo Customer Reviews

What Do Customers Think?

Reading what others said about this platform is a perfect way to be your consideration before choosing it to use. And we provide you with the customer reviews that we got from its official site.

The first customer commented about how helpful this platform is. She said:

We’ve enjoyed FamZoo and it’s been very helpful for my daughter in learning about managing funds. She’s now ready for an account with the bank directly.

It clearly says that this platform truly works and gives a good benefit to every parent who wants to teach their kids about financing and budgeting.

Another review is satisfied with the customer service this platform offer. It states:

Great card and customer service. Definitely will use again when my son becomes older. We are canceling now because my daughter is 19 yrs old and got her own credit card. Thank you for developing this as a way to help teach kids responsibility.

Overall, most of the customers are happy with what this platform gives to them. Thus, it should be there’s no hesitation in using FamZoo.

Is FamZoo Worth It?

If you intend to impart the wisdom of personal finance to your beloved progeny without breaking the bank, look no further than FamZoo. This user-friendly tool is worth every penny and more, a resounding yes to your question.

From prepaid cards to allowances to savings goals, FamZoo provides all the essential features you need to begin your family’s financial journey. Don’t hesitate to give your children the gift of financial literacy with FamZoo.

FamZoo Customer Service

How To Contact FamZoo

Keep in touch with the FamZoo customer service team is as easy as pie since your satisfaction is their number one consideration.

You only need to fill in the form they provided on the contact page. Well, basically, they have already provided some of FAQ that might help answer your questions.

Or, if you want to connect with them directly, their official social media is the best place to visit.

- Facebook: FamZoo

- Twitter: @FamZoo

Oh, the platform’s blog page is another great place to know more about what this platform can give you.

Where To Access FamZoo

Of course, the only place you can visit is its official site, where you shouldn’t doubt its safety and legitimate. There, you can join the newsletter for updated information about this platform.

Conclusion

Are you yearning for a powerful tool to teach your children about personal finance? FamZoo is the answer you’ve been searching for. Trust me; the pros far outweigh the cons. This remarkable tool’s ease of use, affordability, and flexibility are unmatched, making it the perfect choice for families of all shapes and sizes.

Why waste another moment? Sign up now and experience the magic for yourself. Discover why so many families are turning to FamZoo as their go-to family finance app. Your children will thank you for it, and you’ll be grateful for the peace of mind it brings.

Related Articles

The Harvest Plan Review

Simply Business Insurance Review

National Debt Relief Review

LendingWise Review

Checks Unlimited Review