LendingWise Review: Scale Quickly with Well-designed Software for Loan Brokers

Technology brings a lot of help in giving efficiency, including lending programs. If you are a broker who needs assistance in creating a helpful website, look no further than reading this LendingWise review. Therefore, prepare yourself and choose whatever integrations you need to provide a user-friendly platform. So, without waiting any longer, let’s dig deeper now!

This article has been written and updated by L. Ramadhani, last updated 1yr ago. If you like to read LendingWise Review, we must tell you that other 0 readers also love to read more Financial Service Reviews.

Table of Contents

- LendingWise Reviews

- Why LendingWise?

- What's On LendingWise

- LendingWise Integrations

- LendingWise Services

- LendingWise Plans

- LendingWise Pricing

- How Does LendingWise Work?

- LendingWise Pros and Cons

- Is LendingWise Worth It?

- Is LendingWise Legit?

- LendingWise Customer Reviews

- How to Contact LendingWise

- LendingWise Cancellation Policy

- Where to Access LendingWise

- Conclusion

LendingWise Reviews

LendingWise is a SaaS company founded by Chris Fuelling in 2006. It provides a robust marketplace to connect more than 2000 brokers and 400 wholesale lenders.

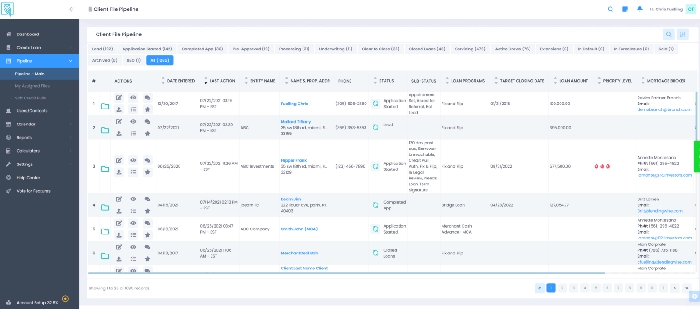

Then in 2017, the company launched a Loan Organization Software (LOS) to empower the lending community. Furthermore, it features a centralized CRM, a cloud-based platform, and the latest Fintech technology.

You can see the brand on Capterra, GetApp, G2, etc. It may not have many followers, only 2.1K on LinkedIn and Facebook, but more than 2 million loans from 1200 companies use the service.

Therefore, read this article thoroughly to dive deeper into this LendingWise review. So, let’s learn how the brand works in the following section now!

Why LendingWise?

This section will discuss the brand’s strength in providing SaaS for all clients. The explanation will allow you to get insights concerning the brand.

So, here we go!

LendingWise Highlights

- Lending Organization Software for lenders and brokers

- Specializing loans for Fix & Flip, Rental, Construction, Biz Funding, etc.

- Trusted by reputable companies, such as C2 Commercial, Horizon Financial, BD Capital, etc.

- Contains 45+ integrations

- Website lending with customizable designs and features

- Offers free booking for demo

- Starters can use a free trial before subscribing to a more prominent plan

What's On LendingWise

You learn enough about this SaaS online service company from the introduction to the strength. But do you know what we will discuss profoundly in this article?

This LendingWise review enrolls on three topics, are:

- Integrations

- Services

- Plans

Without further ado, let’s move to the next section now!

LendingWise Integrations

Providing a platform for brokers is challenging because it requires a lot of features. What are they? Find the brand’s integrations in the table below.

There are around 45 integrations that the brand uses. So here are some examples.

| Dropbox | SalesForce | HubSpot CRM |

| Zapier | Pipedrive | ZOHO CRM |

| Lending Tree | Candy Leads | Microsoft Dynamics CRM |

| Credit Plus | Universal Credit | Birchwood Credit Services |

These technologies allow you to create user-friendly platforms. Therefore, please select wisely the integrations you need to provide the best service for your lenders.

LendingWise Services

Not only is the company providing excellent collaborations, but also there are three services that clients can purchase. Below, I’ll break them down thoroughly.

Find the explanation in the table below!

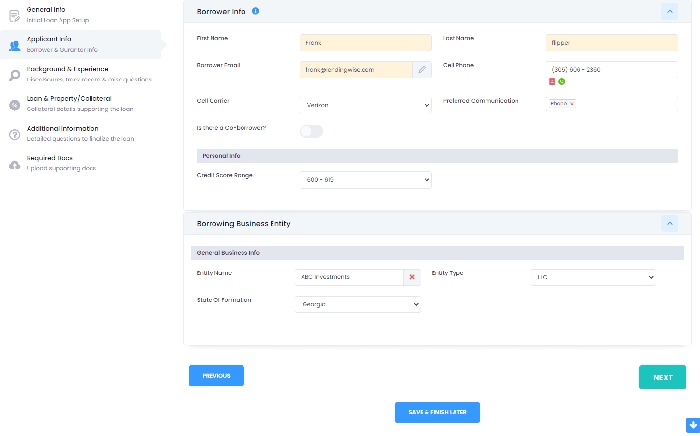

| Implementation & Training | This service offers a package for implementing your plan concerning the configuration and training to complete your loaning system. |

| Loan Processing & Underwriting | This service concentrates on document completion and verification, allowing you to focus on your business with no doubt. |

| Lending Website Templates | This service provides a responsive website for financial affairs, allowing you to customize the templates beautifully. |

All of the offered services are excellent and are accompanied by experts in the lending industry. Therefore, you do not have to be afraid of making mistakes. So, which of them will you order from this online service company?

LendingWise Plans

This online service company offers Starter, Professional, and Enterprise plans. What are the differences between the three?

Here I’ll break them down so you can effectively differentiate the plans.

| Starter | Professional | Enterprise |

|

|

|

If you need additional features, an add-on is available. You may need to pay more, but it is worth checking out. Therefore, click the link below to get the offer now!

LendingWise Pricing

How much does LendingWise cost?

After reading the plans explanations, you may wonder about the price. Luckily, the company offers a free trial which allows you to try the features.

If you’re interested in subscribing to the plan, the price starts from $149.00. It is the least cost you must prepare to have a better lending system. So, let’s get the offer now!

How Does LendingWise Work?

Understanding the procedure of the online service company is not easy. But I’ll try my best to break it down step by step below.

- First, sign up for an account on the official website, then log in.

- Select your preferred service and plans.

- Then complete the payment and follow the guide from the team.

- Tell them your needs from integrations and add-ons.

- After that, customize your website for users and customers.

- That’s it! You are ready to serve the loan service immediately!

Remember to prepare your preferred designs and integrations so the team can provide the best. So, are you ready to subscribe to a plan now?

LendingWise Pros and Cons

In the middle of this LendingWise review, I want you to understand the brand thoroughly through the pros and cons. Here they are.

LendingWise Pros

- Offers Lending Organization Software for lenders and brokers

- Supervises eight loaning products

- Compatible with 45 integrations

- Trusted by more than 120 companies

- It has three available plans

- Offers free trial and free book demo

- Subscribing plan held monthly or annually

- Annual subscription features discounted price

LendingWise Cons

- It doesn’t have a high rating.

Is LendingWise Worth It?

Lenders and brokers may find it challenging to manage the data for loan programs. Luckily, LendingWise will save your life with organized software.

This company is worth subscribing to due to three different plans. Furthermore, you can book a demo to learn the brand’s procedure.

Suppose you do not have enough budget to subscribe; the free trial is ready to help. Therefore, you can save more money and get in touch for the subscription process.

Is LendingWise Legit?

LendingWise is a legit company you can trust to manage your loan business. It provides a company profile with thorough explanations. Also, you don’t have to worry about the data since it has secure SSL certification.

Suppose you need assistance; the contact information is well-written on the website. Therefore, clients can get real help before subscribing to the preferred plan.

LendingWise Customer Reviews

What Do Customers Think?

Aren’t you curious about customer satisfaction? I will break down the rating and quote some testimonials in this LendingWise review if you are.

Currently, the brand gets two ratings from two reviewers, are:

- 5/5 rating from 3 reviews on G2

- 4.54/5 rating from 48 reviews on Software Advice

Here is what a client said:

I would learn the Lending Wise platform very easy and still continue to use the software on a daily basis. We can tweek the platform for our needs.

This client finds the platform easy to use daily. Additionally, she can customize the design and features based on her needs.

Another one said:

The platform covers all bases cradle to grave. The software is the most intuitive one we’ve found that can manage every components of a loans life.

This client loves the coverage of the platform since it has intuitive features. Furthermore, they are easy to use to manage components for loan business.

Therefore, I can say that LendingWise promotes the best feature for lending software. Many clients find the quality easy to use, so the management is efficient and benefits the companies.

How to Contact LendingWise

Suppose you need assistance or want to book a free demo, don’t hesitate to contact the team at the following steps.

- Pop up an email to hello@lendingwise.com

- Call the team at (888) 400 6516 or (788) 833 9520

- Ask immediately on the website’s live chat

- Send messenger chat on Facebook

- Stalk the brand on LinkedIn

The team will book a vacant schedule so that you can learn about the demonstration. Then you may also visit the headquarter at the following address.

LendingWise Address

4520 SW 62nd ct

Miami, Florida, US

LendingWise Cancellation Policy

Luckily, this company does not force users to have annual contracts, which may be burdening. In contrast, you will have a month-to-month agreement.

You may also enjoy discounted pricing for quarterly or annual options. Therefore, clients can subscribe to the plan whenever they need or stop it once the agreement period ends.

Where to Access LendingWise

The only place to access this SaaS company is the official website. You may request a free demo to get more insights concerning the process.

Furthermore, this demonstration allows you to consider how practical the application is. So then, click the link below if you want to use its service!

Conclusion

A loan business requires a lot of effort in managing essential data. Thanks to LendingWise, lenders, and brokers would not feel tired anymore due to the intuitive features of Lending Organization Software (LOS).

Not only can you customize a website, but the integrations contain more than 45 systems. So if you want to manage your lending requirements, book a demo now!

Related Articles

The Harvest Plan Review

Simply Business Insurance Review

National Debt Relief Review

Checks Unlimited Review